In today’s highly complex global business environment, companies are constantly expected to do more with less, to run leaner while becoming more effective than ever. This is especially true for Accounting and Finance. They are now required to not only deliver periodic financial data and reports, but also real-time analysis and intelligence.

BlackLine’s Finance Transformation solution empowers accounting and finance leaders to gain full control over the financial close process by automating accounting workflows, providing a secure workspace to complete period-end accounting activities, and streamlining financial reporting.

Automation removes much of the complex, manual, and error prone steps inherent to dated accounting practices, and frees accounting departments to add more value to the business by shifting focus from processing transactions to analyzing them.

Our most comprehensive solution is designed for organizations to gain the maximum benefit of BlackLine. It provides a full range of automation and controls capabilities that enable organizations to leapfrog the traditional record-to-report process.

Over time, it creates clear visibility into accounting and business process performance to push continuous improvement.

Centralizing and validating data in a single source, coupled with approval workflows and escalation and exception management automation, ensures accurate financial data to better equip leaders with the intelligence needed to make better decisions.

Enhanced controls and standardized global finance processes ensure companies reduce the risk of misstatement and control failure, increasing financial statement integrity.

Organizations using BlackLine gain point-in-time visibility into financial results, ensuring everyone from individual contributors, to managers, to the CFO all see the latest results, in real-time — no more guessing.

Add the capacity to absorb increased business requirements as automation, control, and visibility combine to help scale productivity without sacrificing timeliness, consistency, or confidence in financial reporting.

BlackLine streamlines and automates your financial close, integrating with your disparate financial systems every step of the way. It provides matching, reconciliation, and autocertification using configurable business rules, process and workflow management for reconciliations organized around accounts and transactions, and further individual close optimizations such as intercompany reconciliation, open items clearing, close management, and variance analysis.

Centralize journal entry management to control creation, review, and approval of journals with electronic certification and supporting documents. Automate pre-posting validation to catch entry or logic errors, ensure accuracy, and eliminate GL and subledger rejections.

Stay on top of key accounts by combining them to streamline the regular monitoring and verification of high volume accounts before the period end, and on a schedule of your choosing. Match multiple transaction data sources – bank, POS, GL, etc. – and address exceptions immediately.

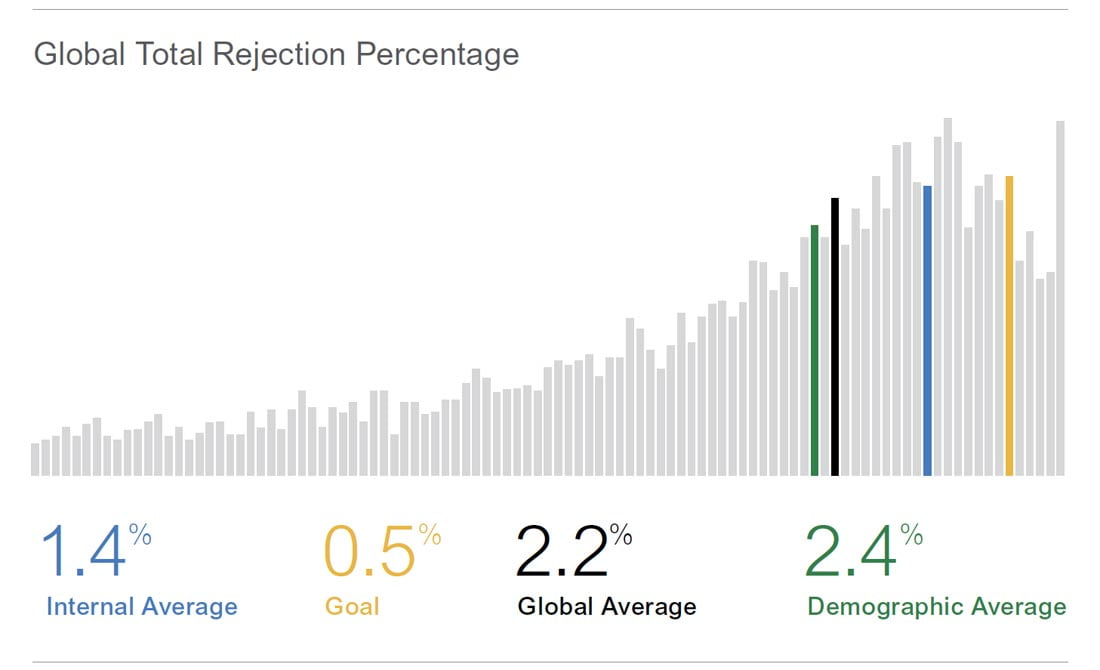

Optimize Finance and Accounting and continuously improve operations by comparing against benchmarks across industries, company size, and geography. Review and analyze period-end accounting performance within your company to optimize workload and outcomes over time.

Make the most of your BlackLine investment. Test products, settings, and data imports and maintain change management compliance in a cloud environment thatmirrors, but is completely separate from, the BlackLine production workspace accounting teams are using every day.

Manage accounting tasks across the organization, including reporting and reconciliation approval. Automatically certify tasks in a hierarchy when child tasks are complete. Control and track a variety of task types including close checklists, PBC lists, tax filings, and more.