When the Corona crisis first hit, the main focus for businesses was to maintain their supply chains in the short-term. Now, as businesses attempt to compensate for the negative effects caused by the crisis, focus is increasingly shifting to cost and efficiency issues.

In contrast to direct material costs, the following costs can be influenced much more easily; procurement logistics, internal logistics, warehouse management and distribution logistics. These areas are often not recognisable at first glance but can help your business to accelerate its recovery by offering considerable potential for savings and increases in efficiency.

To quickly identify and exploit the hidden potential, a systematic 6 step road map should be used

Roadmap in 6 Steps:

To minimise risks and avoid any delays in the recovery phase, businesses should analyse their supply chain and then take appropriate actions accordingly. Missing parts of production are the main reason for reductions in sales, especially for businesses in the manufacturing sector2. Businesses therefore have to analyse their own product portfolio in order to identify threats.

The Corona crisis was a driver of digitalisation. At the start of the crisis, many businesses implemented operational short-term solutions under high pressure. The main aim here was to secure their operational processes, however, many of these solutions are not sustainable in the long-term. To accelerate recovery, businesses have to consolidate and professionalise these new processes, from modernising IT structures to training employees to optimising processes.

Similarly to supply chains, the crisis highlighted that in many companies their administrative processes are not crisis-proof. These must now be adapted to the “new normal”.

Medium-sized businesses in particular were already behind with digitalisation before the crisis3 and now this gap is threatening to grow. Businesses should do the following to quickly secure their ability to act and drive towards economic security:

• Process audit

• Weak point analysis

• Prioritisation of areas to action

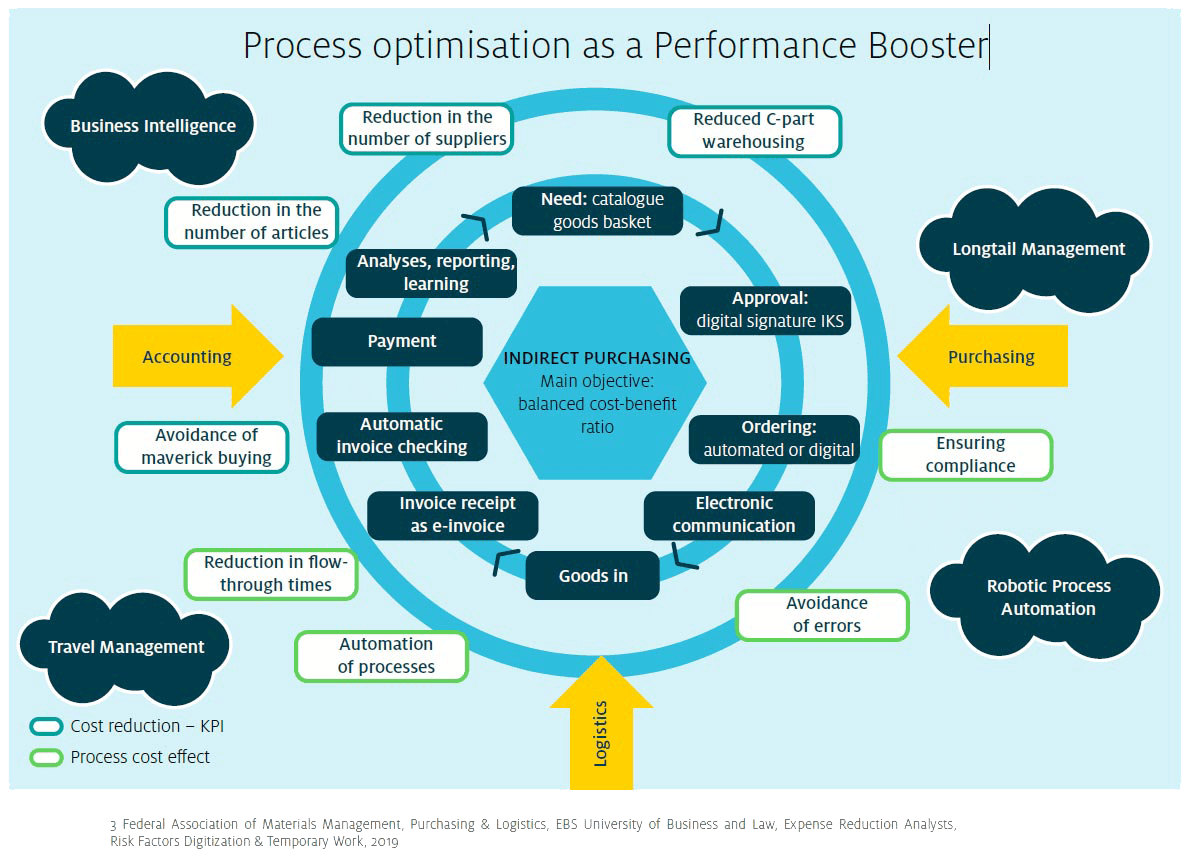

Important aims are the growth of efficiency and speed, reduction in the frequency of errors, and process security independent of location. The example of digitalised procurement below shows the possibilities

Cash is King. Especially in times of crisis and against the background of a 20% drop in sales across businesses. To recover quickly and secure liquidity, businesses have several options:

To achieve maximum success, management must be in full control. All areas that have an impact on cash flow must be integrated so that in addition to immediate measures, medium and long-term actions can also be carried out in a targeted manner.

Impacts on financial planning and the financing structure (caused by the revolving liquidity planning in the short-term) must be taken into account in the medium and long-term. Banks have to be provided with transparent and timely information, credit lines have to be renegotiated and new or alternative forms of financing should be considered

Businesses are currently facing two major challenges. First is the management of negative economic effects caused by the Corona crisis; and second is sourcing the workforce needed to rebuild a business. To restore competitiveness, companies need to realign their most important resource, their team. Re-evaluating particular areas within Human Resource processes will help to achieve this as well as accelerate your recovery strategy.

About Expense Reduction Analysts

Established in 1992, Expense Reduction Analysts (ERA) is one of the world’s leading consultancy organisations. Specialising in cost optimisation and supplier relation management, ERA delivers Value through InsightTM to clients in both the private and public sectors.

With more than 700 consultants operating in over 35 countries, the award-winning business boasts international expertise while simultaneously offering a local presence to clients.

Through in-depth industry knowledge and insight across a variety of expense categories, ERA adds value to organisations by advising on industry-specific best practices, reducing costs and ultimately delivering tailored solutions to benefit business health and growth.

For over 25 years, Expense Reduction Analysts has improved business performance for thousands of its clients, including many well-known names.